Ep. 241 – 2023: The Trio’s Property Predictions – who got them right? and did we get any wrong?

<

Highlight segments:

0.54 – Mike welcomes Pete back to the studio!

11.03 – Pete shares some fundamental reasons why Perth was destined for investor interest in 2023

14.28 – Let’s talk about the regions!

21.31 – Mike ponders the impact of investor disincentives with Dave, Cate and Pete

28.28 – Sneak peek into next week’s episode – the December market update

46.00 – What risks could impact the 2023 market? The Trio share their fears

55.28 – Gold nuggets!

Pete joins us in the studio! Mike kicks off the Trio’s predictions for 2023 and he runs through their January predictions, holding each accountable for their forecasts.

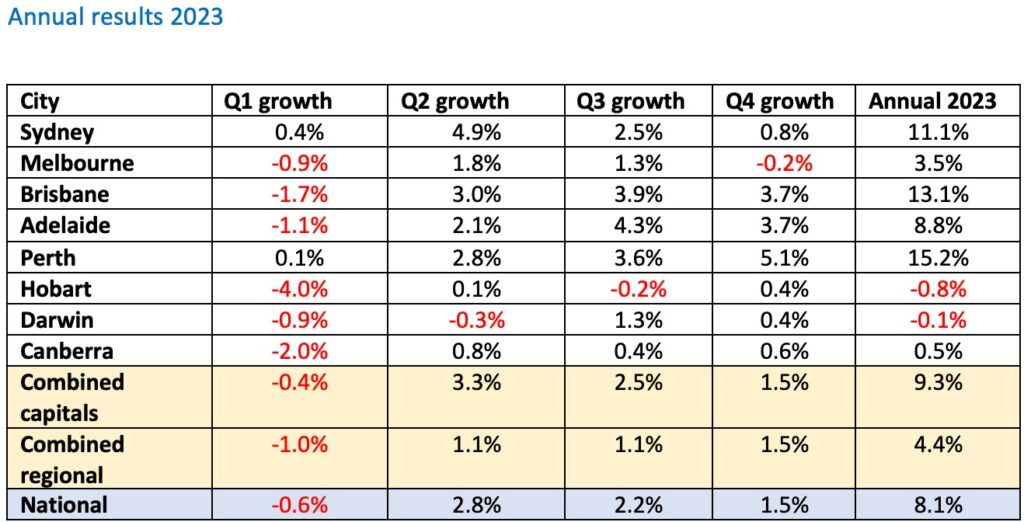

What will the market do? Cate admits she was quite bullish on this question, while Dave thought prices would drop 5-8%. It was the Property Professor who got this prediction right.

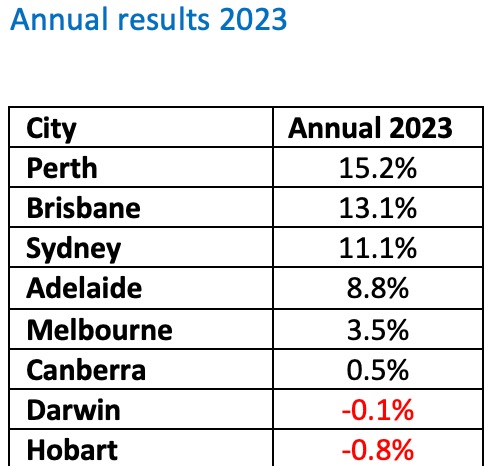

Which capital cities will be the top performers? According to Mike, the Trio all got this one right in identifying Perth as a top performer. Cate concedes though that Melbourne demonstrated resilience, as opposed to a bounce-back, and she points out that none of them picked Brisbane.

And Pete sheds light on some fundamental reasons why Perth was so popular for eastern states investors.

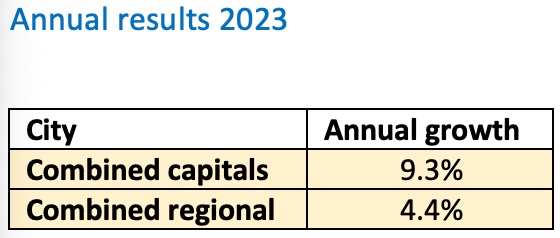

How will the regions perform? With hybrid office working environments, things are changing now, but what will the larger regions do in the short term? Who got it right? And what is in store for office spaces? …Tune in to find out.

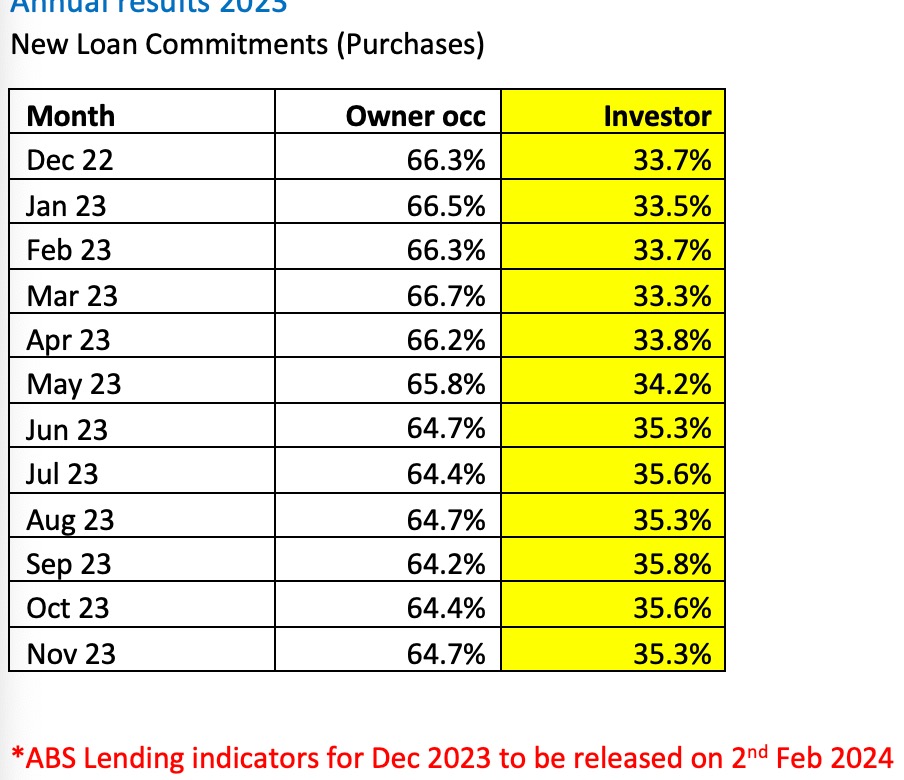

Investor numbers: What did the Trio underestimate? How has credit policy played a role? And how did tax legislation changes impact investor activity? The Trio ponder.

What government intervention could impact the property market? Each of the Trio had a good point, but who got it the ‘most’ right?

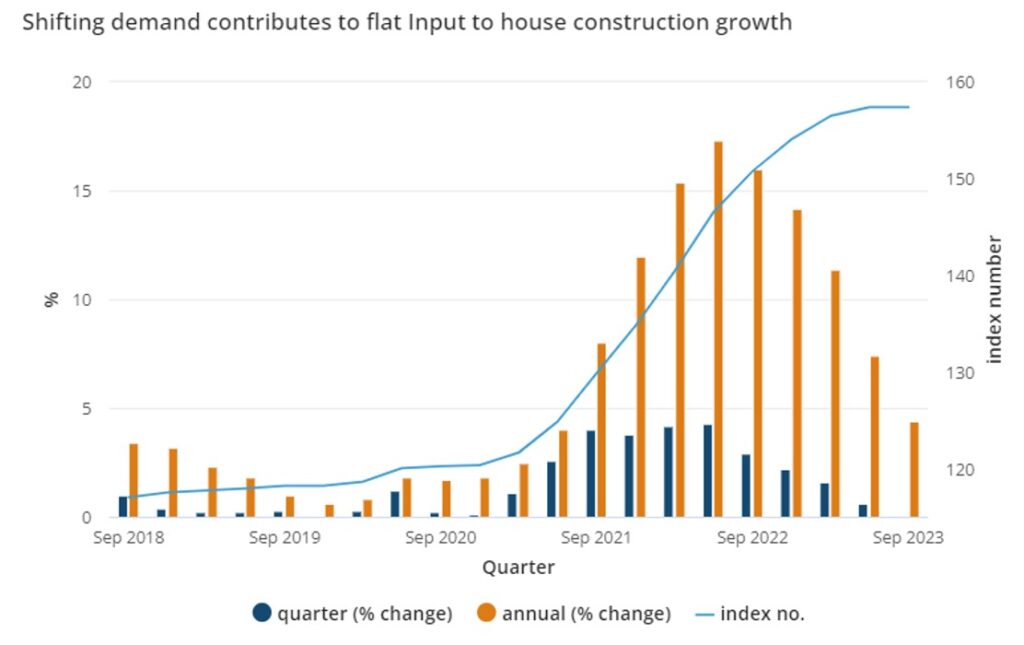

Developers and building – what did the Trio think would be in store for 2023? Why could we see private builders ease their pricing? Does Cate have a valid theory? And Mike sheds some light on the challenges today for volume builders… and it’s insightful. Pete adds his insights on the current building pipeline and Dave discusses supply chain woes. Dave was determined the deserved winner of this prediction.

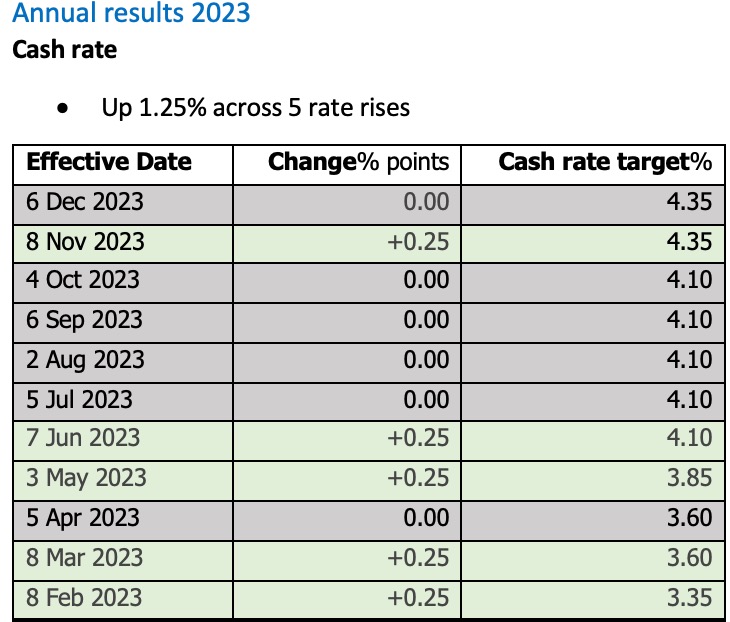

Where will interest rates land at the end of 2023? The Trio concede defeat!

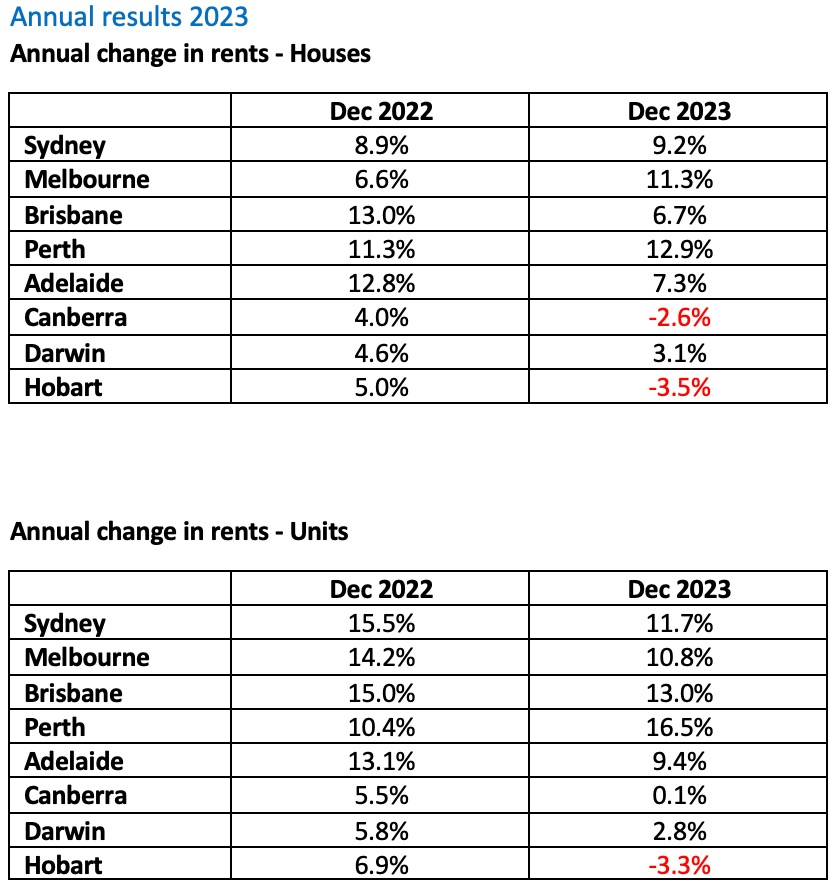

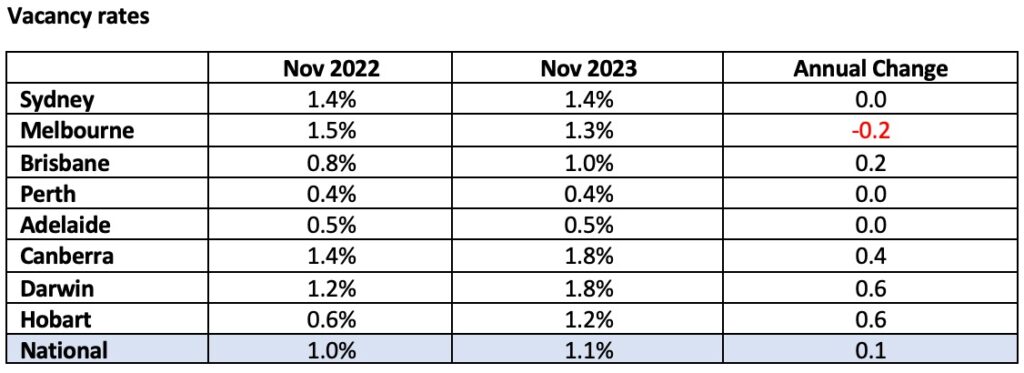

Rents and vacancy rates – where would they end up at the end of 2023? Cate and Pete took out top marks for this prediction: “Record increase in asking rents for 2023. It will shadow 2022, we’re not getting more stock, we’re getting more people. With interest rate increases, some people who were looking at purchasing might be looking at renting instead.”

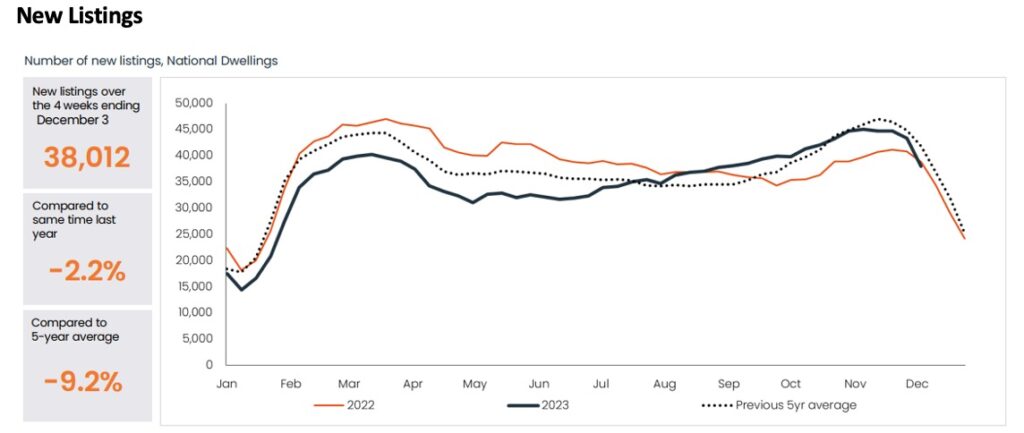

Where did the Trio peg listing and sales volumes by year end 2023? Full marks to Dave! “We’ll see it around the 5 year average this year, first 6 months will be flat, but pick up in the back half of the year.

And what risks did they anticipate could impact the market? From recession to higher unemployment, war/invasion and share market corrections, the Trio canvas some of the possibilities.

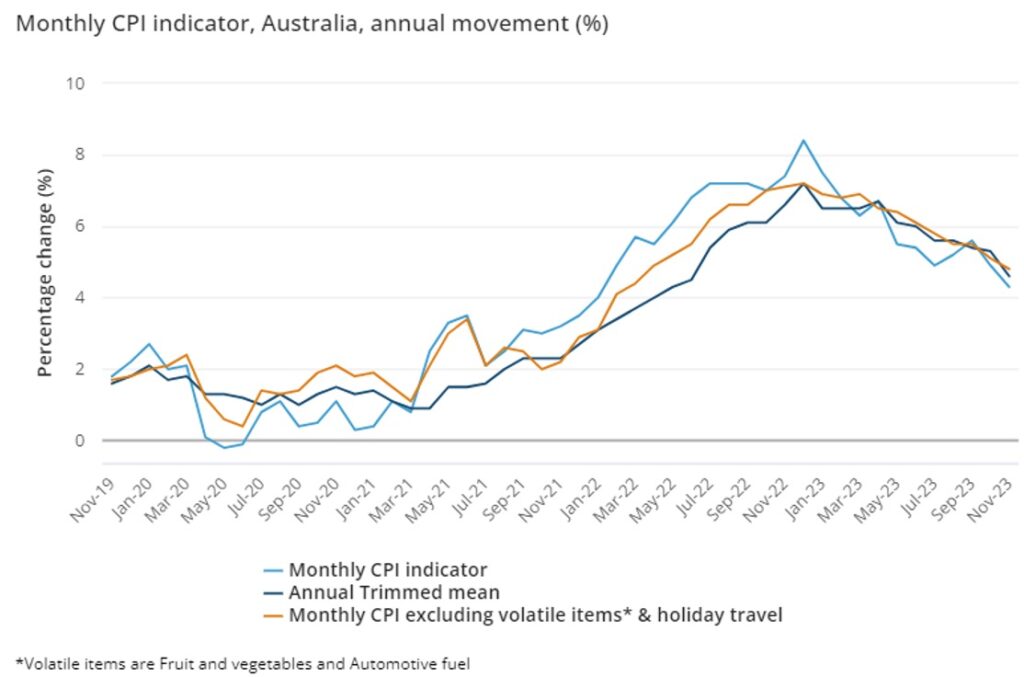

Lastly….where did the Trio think inflation would head? Pete speaks candidly about the practicality of reading inflation charts. But did Dave and Cate get it right? Or were they one year too early with their predictions?

….And our gold nuggets!

Peter Koulizos’s gold nugget: Borrow as much as you can to buy as much as you can, and hold on for as long as you can!

Cate Bakos’s gold nugget: The differences of opinion between the Trio is what makes the show interesting, but it also sheds light on the importance of noting different economists’ points of view. We pride ourselves on being fiercely independent.

Thanks Pete!

And if you have enjoyed this episode, we recommend you listen to these eps:

Ep. 52 – Dissecting ten years of Core Logic data; capital cities and regional areas

Ep. 155 – Plotting Australian property market movements – from 1970 to now

Ep. 158 – How interest rate cycles have impacted the property market since 1990