Ep. 263: Strategies for Early Homeownership, Passing on Money Management Wisdom and Teaching Financial Independence

3.02 – Dave opens the episode by referencing the increased percentage of first home buyer participation. What could be driving this?

6.55 – The Trio reflect on the various first home buyer incentives offered by our governments, past and present

24.14 – What issues can strike when parents are too generous?

28.00 – How can we give our kids some agency?

30.01 – Next week’s teaser… Rent-vesting; unpacking the pros and cons, why it’s gaining traction, and how to work out if rent-vesting is the right step in your property plans

30.28 – Cate shares hers and her husband’s approach with her daughter’s property deposit savings regime

52.42 – Gold Nuggets

Helping versus hindering our children’s financial futures… it’s all about mindset! Dave hosts today’s episode and the Trio enjoy sharing their thoughts about the various ways we can help our children get a foot on the property ladder.

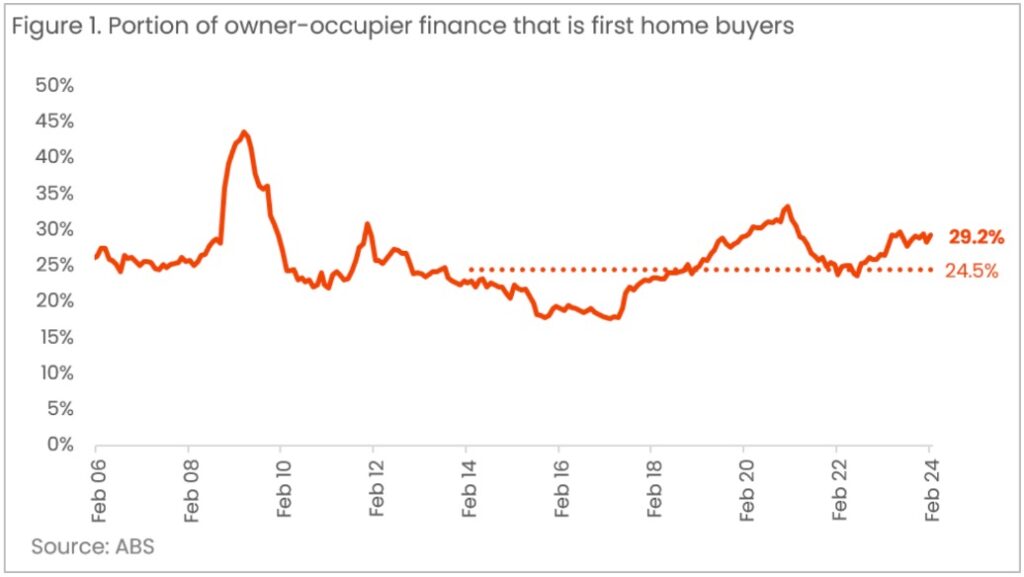

First homebuyer participation is up a little bit when contrasted against recent years. Dave runs through some of the key reasons that could be contributing to this increased level.

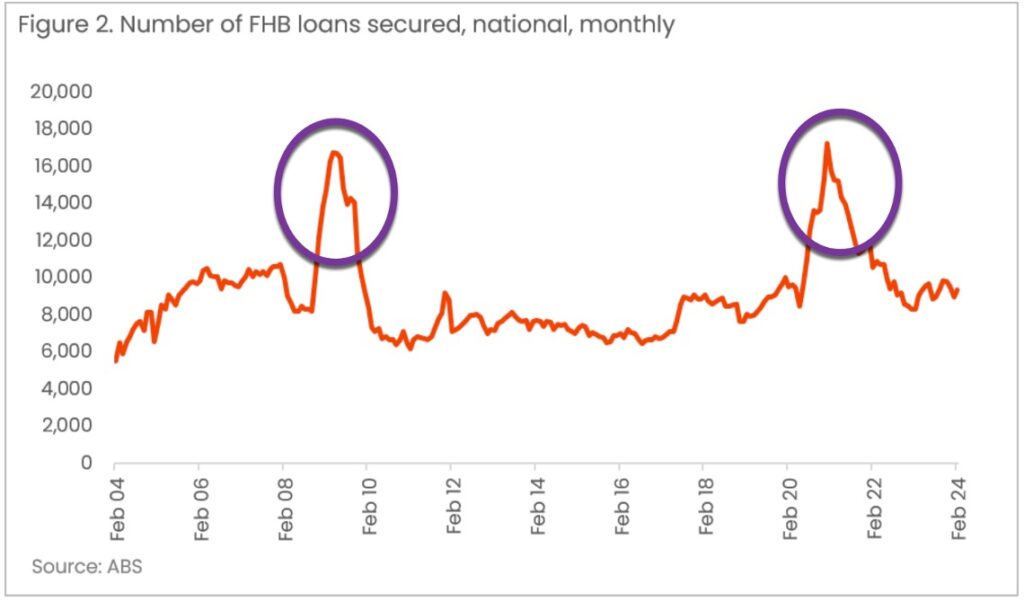

First home buyer activity bounced up with targeted government incentives during GFC recovery and COVID recovery. Both also had record low interest rates.

“The series shows only two substantial spikes in first home buyer loans between 2008-09 and 2020-21. These can largely be explained by temporary government incentives for housing purchases.

There was a temporary boost to the first home owner grant introduced around the GFC, and a temporary HomeBuilder grant introduced around the onset of the pandemic (which was not specifically targeted at first home buyers, but could be used in combination with the then recently introduced ‘First Home Loan Deposit Scheme’).” (Source: Core Logic)

The Trio take a walk down memory lane as they recall some of the various first home buyer incentives introduced by our governments since the GFC.

Dave canvases the concept of false economy when it comes to incentives and price points that some buyers chase that don’t completely align with an optimal strategy.

Cate delves into some of the issues that could arise when parents’ generosity is too great.

From a lack of appreciation to jealousy among peers, (and many others), there are some significant risks that need to be considered.

Cate chats about hers and her husband’s approach with their daughter’s property deposit savings regime. From a small inheritance from her grandmother a few years ago, followed by ETF share portfolio outperformance of that little nest egg, this seventeen year old has been making regular contributions to her portfolio with her part time job. What is the deal that Cate has struck with her? Tune in to find out…

The Trio reflect on the great encouragement that their own parents imparted. Thinking about the great lessons and moments of pride during our own childhood can lead to some great ideas that can be paid forward.

And lastly, Cate talks about some of the non-financial ways that we can make a positive difference for kids these days.

…. and our gold nuggets!

Cate Bakos’s gold nugget: When you’re working out how you can help your kids with their financial future, make sure you let it be their journey.

Mike Mortlock’s gold nugget: Mike reflects on Cate’s daughter’s $5000 nest egg which was compounding. That ‘early win’ is a very valuable introduction to good investing.

Dave Johnston’s gold nugget: Getting his children applying some research and selecting companies in a share portfolio from the age of grade six is an exciting plan that Dave has been considering.

Resources:

We have some articles and blogs relating to this episode below.

If you enjoyed this episode, you may also enjoy these:

Ep. 29 – Congenial negotiation tactics and how to apply them in the right situation

Ep. 30 – Money Management – 7 steps to success

Ep. 33 – Starting without a plan and end goal – No.3 of the top 7 Critical Mistakes

Ep. 95 – Security guarantees, co-borrowing, gifts and more – Helping your kids buy their first property

Ep. 181 – First Home vs Forever Home; Dream Home vs Investment – What are the trade-offs and key considerations?