Ep. 271: Market Update July 24 – Adelaide Closing in on Melbourne’s Median, Investors Return in Force & Renters See Relief as Growth Slows

Ep. 271: Market Update July 24 – Adelaide Closing in on Melbourne’s Median, Investors Return in Force & Renters See Relief as Growth Slows

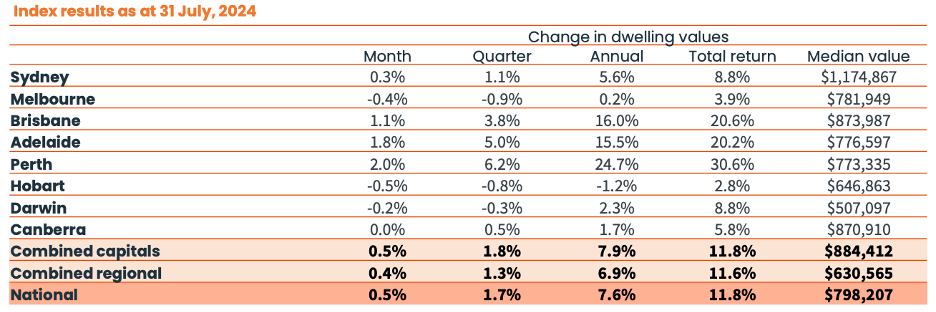

Mike kicks off this episode, and the Trio reminisce about Pete Koulizos’s special place in the history of the show as they marvel at Adelaide’s stellar growth. How sustainable do they think the City of Church’s continued growth is?

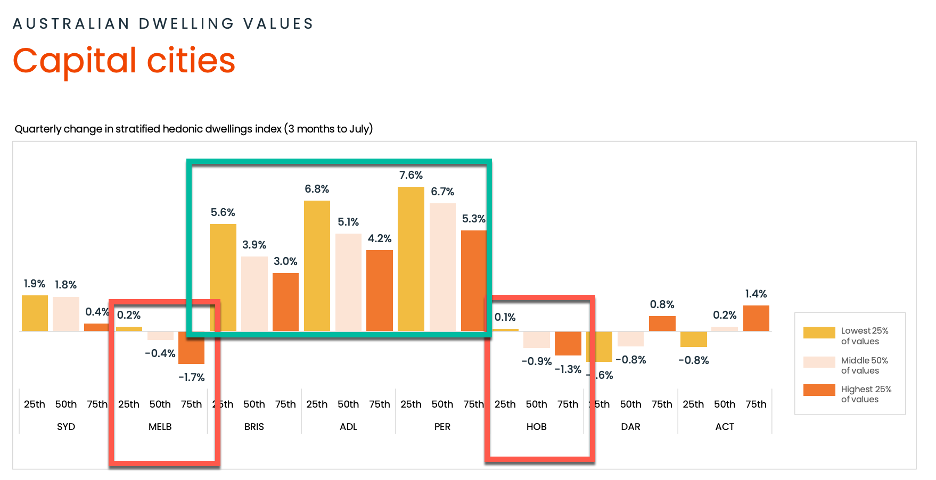

Dave references the quartile performance breakdowns, and the possible leading indicators when it comes to capital city growth cycles. The softening of the higher priced quartile of the market is important to note.

The market sentiment is currently hinging on interest rates and the possibility of a rate cut, and Cate canvases the challenges associated with this, and in particular, her local market. Despite the heightened listing activity, interstate investor interest is buffering Melbourne’s price falls.

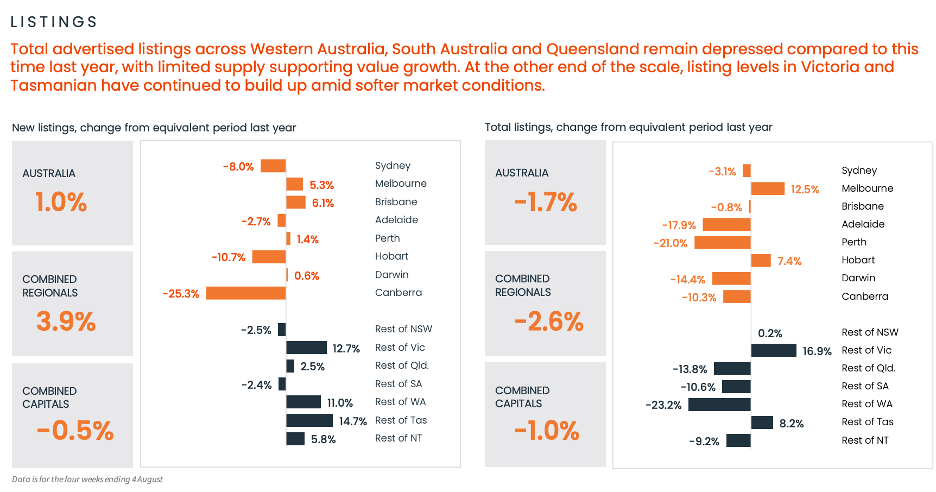

The difference between the heated markets and the softer markets at the coal face boils down to the sense of urgency. Brisbane, Adelaide and Perth are plagued with tough buying conditions, while other softer markets are experiencing longer days on market, more indecision and relaxed competition.

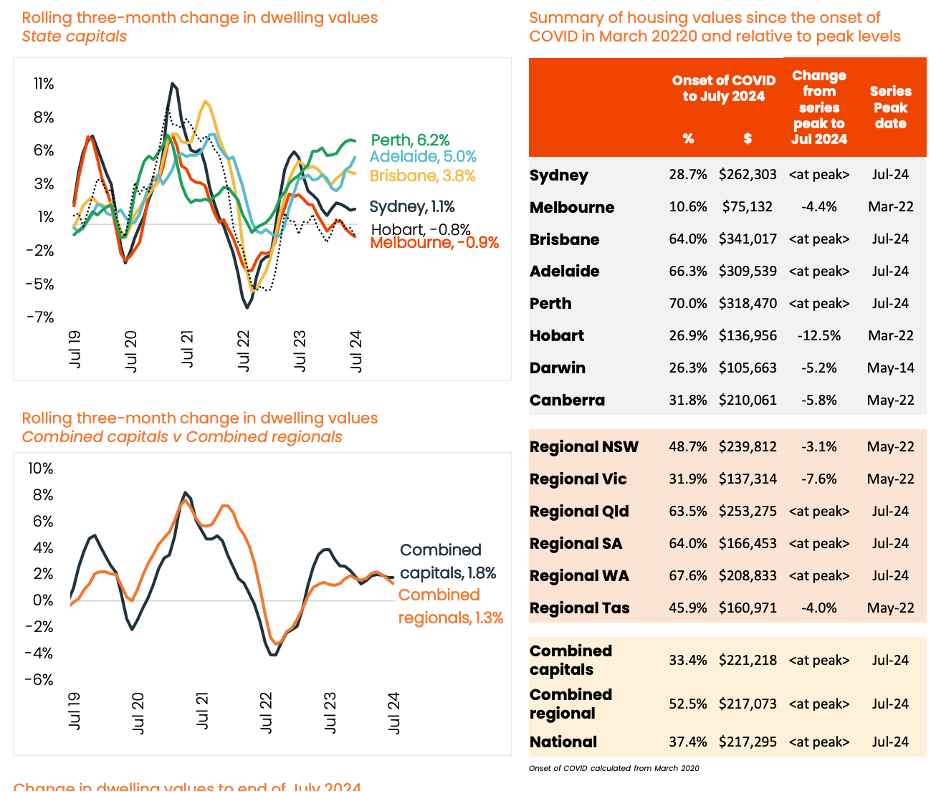

The chart illustrating the onset of COVID in March 2020 relative to peak levels attracts some attention and the Trio consider the growth drivers, inhibitors and obvious reasons for the vast differential in growth figures.

Considering that during this time, three cities that have delivered between 64%-70%, contrasted to 10.6% and 28.7% in Melbourne and Sydney, respectively is fascinating. How important is timing, and can we pick a market peak and trough?

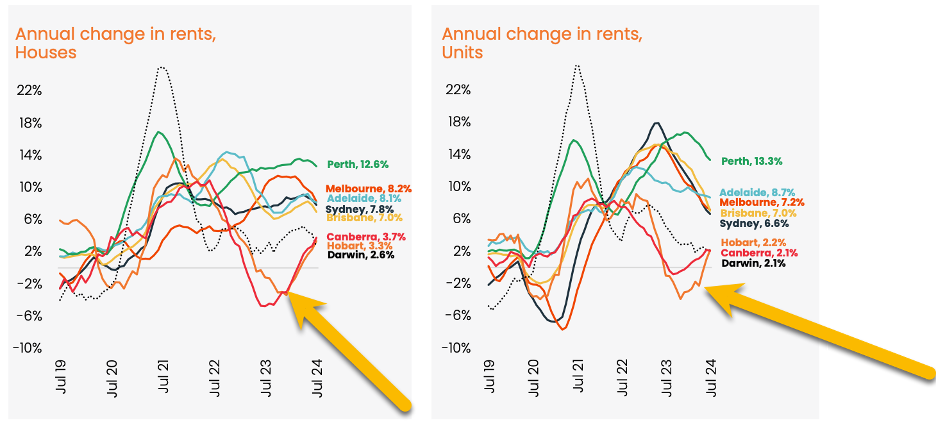

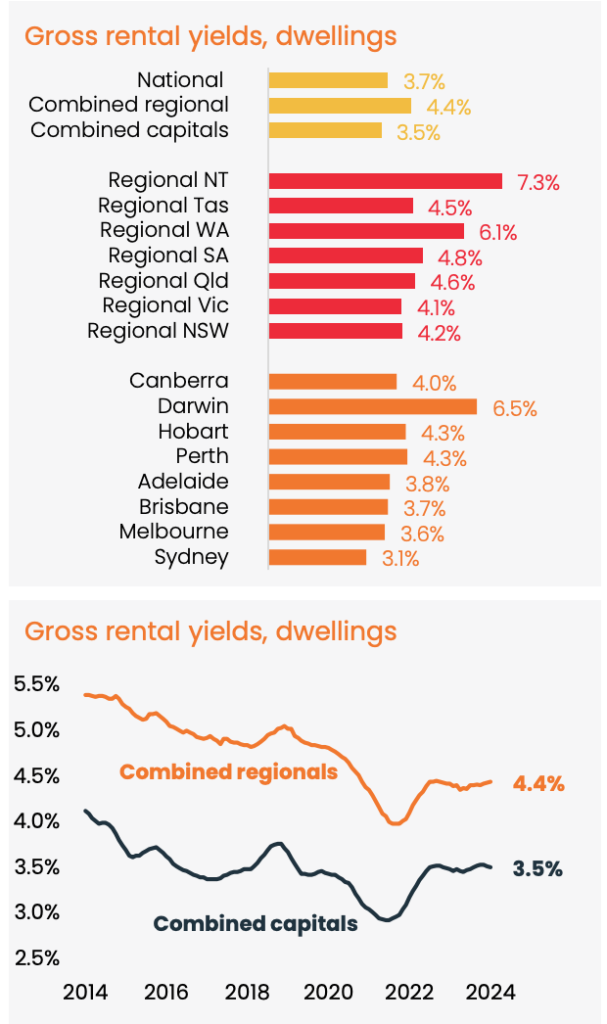

The rate of rental growth is the smallest monthly rise since August 2020 and some markets are exhibiting rental drops. It’s fair to say that rental movement appears to be plateauing now. Cate reminds listeners about the seasonality of asking rents and rental stock, particularly in cooler climates.

Dave hints at the impact of reducing rental rates on the CPI money markets also, and considers that the impact on inflation could be positive.

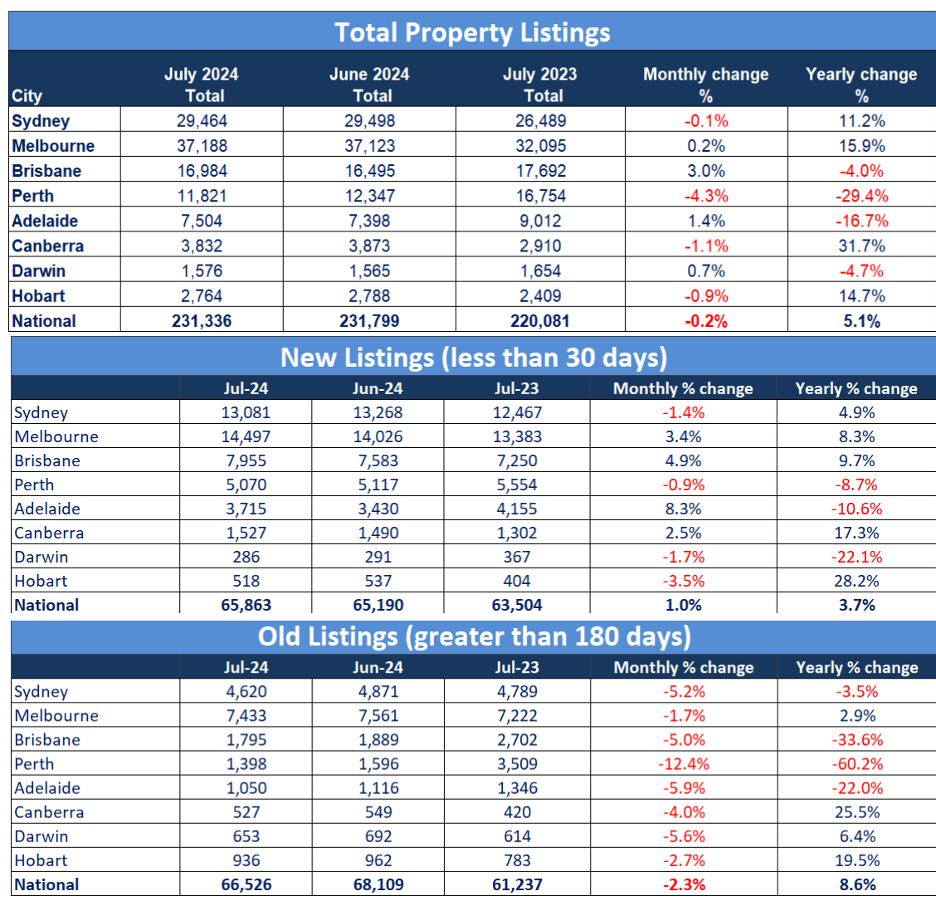

And what is happening with listings? We have more new listings than previous years, but our total listing figures are still below historical levels. Mike points out the correlation between listing figures and capital growth and Dave circles in on Brisbane. Could heightened new listing figures hint that Brisbane’s market is peaking?

The standouts in the Westpac Consumer Sentiment Index are relate to the Interest Rate Expectations index and the Family Finances vs a Year Ago. Are households getting accustomed to the conditions now, or have household savings stabilised now that some of the other costs like fuel and consumables have calmed down….. or could it relate to the recent tax cuts?

Mike points out the impact of insurance and the costs associated with natural disasters on the inflation figures.

Breaking the figures down into states and territories is interesting though, and NSW records the bleakest outlook for Time to Buy a Dwelling, as Dave cites.

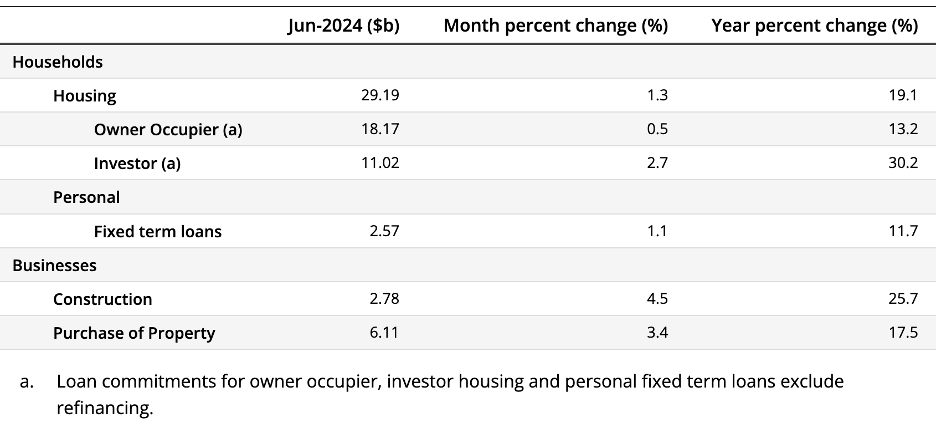

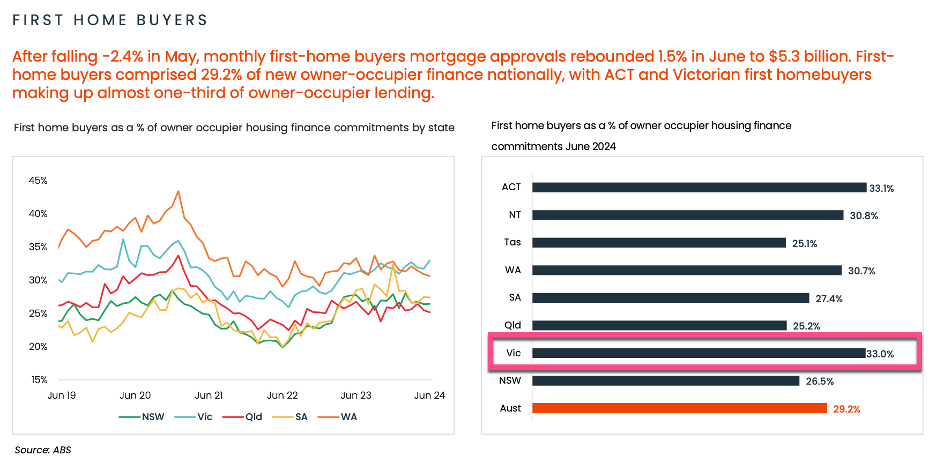

The figures within the ABS lending indicators data demonstrate that investors are certainly strong. Owner occupier finance for first home buyers is reasonably strong in both QLD, VIC and ACT and Dave puts this down to incentives and government support.

Lastly, Dave discusses the delicate balance between interest rates, the unemployment rate, and the complexity that the Reserve Bank board have to consider at every step.

And… time for our gold nuggets…

Mike Mortlock’s gold nugget: While the monthly updates are great, month to month isn’t a big indicator of movement. It’s really the trends that we need to pay attention to.

David Johnston’s gold nugget: “If you’re not willing to purchase interstate, then the month to month figures aren’t that relevant. If you’re not willing to purchase interstate, then the best time is now.”

Cate Bakos’s gold nugget: Household spending of toys has been curbed, and Cate takes some encouragement from the decrease in travel/holidays in the finance and spending activity figures. Here’s hoping for an interest rate cut soon!

Resources:

If you’ve enjoyed this show, take a listen to these eps:

Ep. 10 – Why Your Approach and Assessment of Risk is Paramount to Property Success

Ep. 12 – Property Cycle Management

Ep. 18 – When to Hold and When to Fold

Ep. 60 – Why Established Properties Out-perform

Charts sourced from Core Logic and SQM