Ep. 275: Market Update Aug 24 – Perth & Adelaide Surpass Melbourne Median, Buyer Sentiment Up in NSW & Vic as National Market Cools

Ep. 275: Market Update Aug 24 – Perth & Adelaide Surpass Melbourne Median, Buyer Sentiment Up in NSW & Vic as National Market Cools

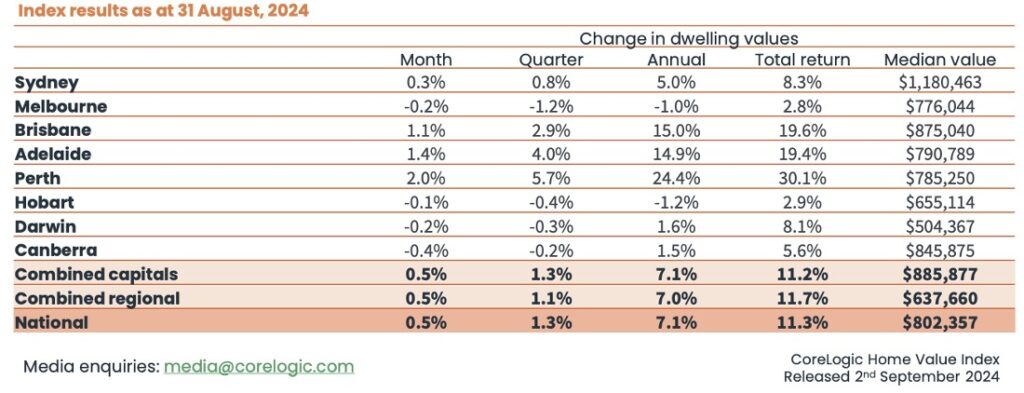

Mike kicks off this episode, and after establishing Dave’s surname’s correct spelling, the Trio launch into the August figures. National figures were up across the board +0.5%, but as Mike eludes, it’s really a tale of eight cities.

How long can the three top performers maintain this strength? And are they at their peak? Perth’s annualised growth is currently sitting at 24.4%, which is significant by any historical measures.

“We’ve got three very heavy lifters, and their growth isn’t really easing”, says Cate.

Although Dave’s focus on Brisbane’s growth rate suggests it may be a city that is coming off it’s recent high pace of growth.

Interestingly, median values are not the most reliable indicator of places on the performance league ladder. The Trio have discussed the imbalance of houses to units in the various capital cities, and they cite this example as a case in point. Given Melbourne has a higher proportion of units than each of Adelaide, Perth and Brisbane, the median value figure is influenced by this ratio in every city.

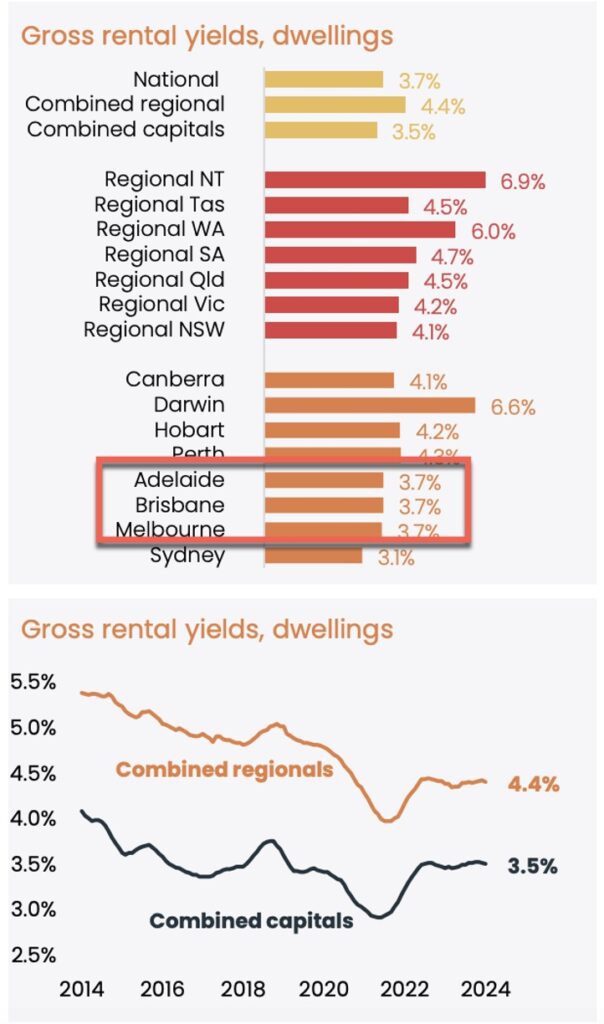

What could trigger Melbourne’s market to rebound? Cate steps through her three possible triggers for change. Dave points out the rental yield figure; a potential indicator of a price signal to a lot of investors. For the first time in the history of the Core Logic gross rental figures, this is the first time that Melbourne has been on par with Brisbane and Adelaide.

The Trio delve into the impact of COVID and the market recovery, followed by Victoria’s static performance on the Victorian regions.

Will pressure on rents continue to ease? Supply is our challenge, but quite a few cities are showing a slowdown in rental rises. An increasing household formation rate, seasonality in the southern states, and lower student numbers are contributing to some of the easing. In addition, holiday house sales have softened the rental conditions, as has the return to work for many workers. Less people need their additional bedroom for work-from-home purposes, hence household formation rates have been able to increase.

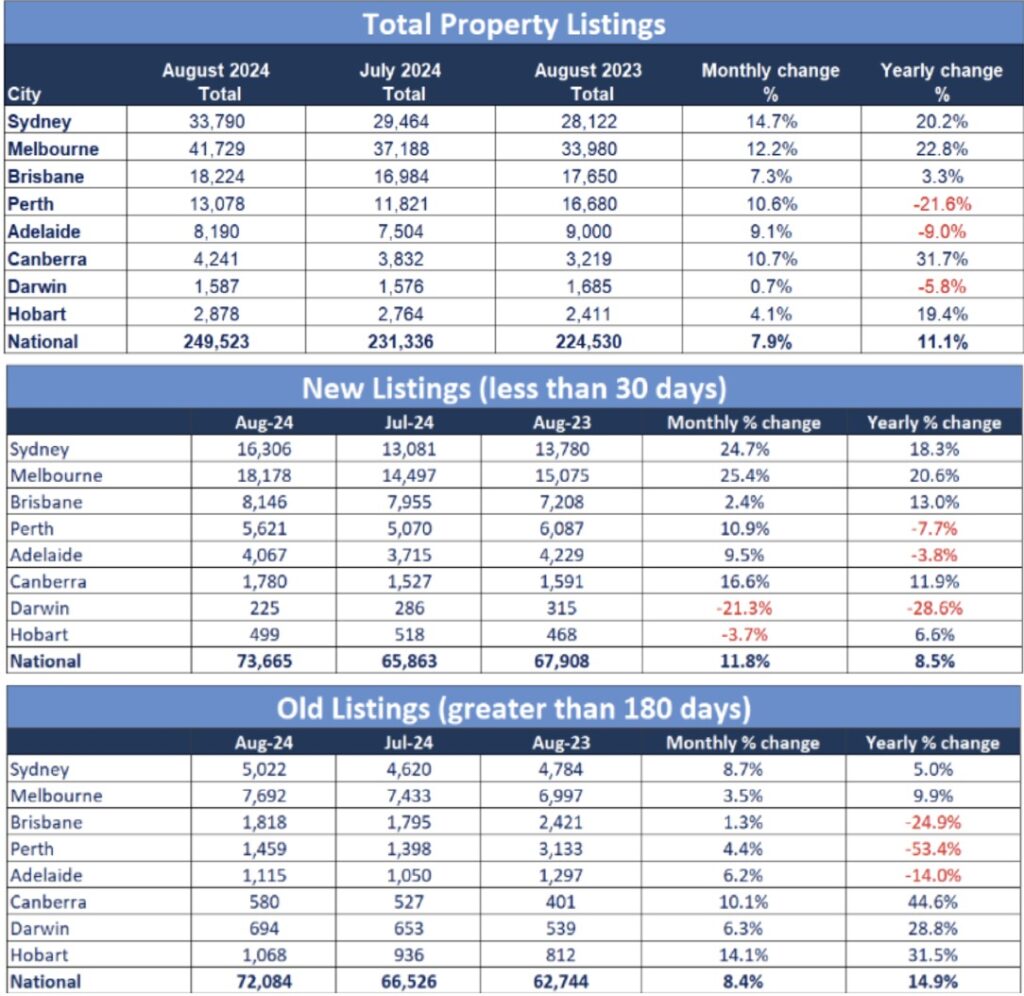

Listing numbers count for a lot when it comes to capital growth, because supply and demand can tell us a lot. The three high performing cities have particularly tight stock levels and a decline in old listing numbers, however Brisbane appears to be exhibiting higher new listing numbers this month; a possible sign of market easing.

And while listing figures are segmented for cities, unfortunately they aren’t segmented for dwelling types, and as Cate points out, there are markets within markets.

The Trio cast their gaze over the Westpac Consumer Confidence Index. A slight increase in the ‘time to buy a dwelling’ looks significant until we recognise that sentiment to buy a dwelling is still well under 100, indicating that less than half of the population believe that now is a good time to buy a dwelling. Dave’s state-based focus is intriguing though. Which cities have had modest increases, and which have shown far higher figures? The answer may surprise…

And when it comes to ‘House price expectations index’, “We’re still optimistic, but not as optimistic as we were”, says Mike.

And Cate estimates that next month’s index will show a decrease in the figure for ‘time to buy a major household item’, due to affordability biting and household savings reducing.

Inflation remains our RBA’s challenge. As Dave points out, inflation hurts everyone, while higher interest rates hurt a segment of our market. Our reserve bank governor’s caution is palpable and the Trio’s general consensus is that we won’t see an interest rate cut in 2024.

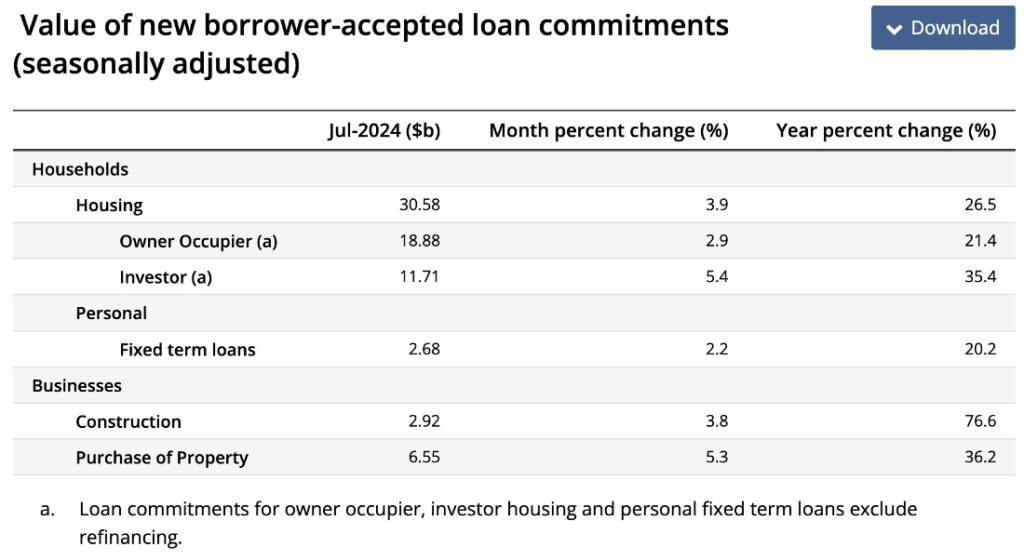

Turning to finance and lending; refinances have fallen away and loan percentages have been impacted by this change. But what has caused the tumble in refinancing? The Trio unpack the various triggers for this.

And the Trio consider Loan to Value Ratios (LVR’s) and the historical changes that have occurred with leveraging, deposit sizes and costs of borrowing….. an ep in the making!

Dave, Cate and Mike discuss the intricate balance that the RBA have to manage between inflation, employment, wage growth and market confidence.

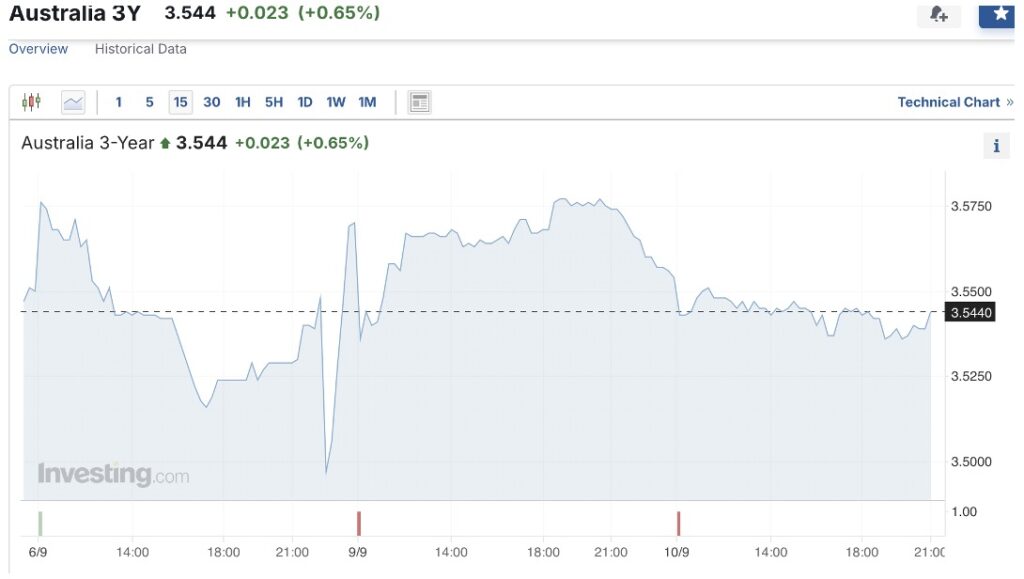

Lastly, the three year bond yield currently sits slightly below our current interest rate and indicates a potential for short to medium term market expectations for a rate reduction (or two or three)… time will tell, but our money markets are interesting leading indicators.

And… time for our gold nuggets…

Cate Bakos’s gold nugget: For all of the investors who have been experiencing rental growth…. we have to keep market conditions in perspective, and given rental growth is slowing, investors need to pay attention to their property manager and take on good advice.

David Johnston’s gold nugget: “If you invest, expect ups and downs, but don’t lose sleep during the downs. Usually, when we make mistakes, it’s when our investments are flat, and people feel the heat and sell.” Maintaining a long term, pragmatic expectation is a healthy perspective.

Resources:

If you’ve enjoyed this show, take a listen to these eps:

6 – What determines your Property Strategy

10 – Why your approach and assessment of risk is paramount to property success!

18 – When to hold and when to fold!

60 – Why established properties outperform

Charts sourced from Core Logic, ABS and SQM