Ep. 280: The Impact of Infrastructure on Property Values & Choosing Between Melbourne and Brisbane for Your Next Investment

0.55 – Dave kicks off today’s episode with two great listener questions for the team to dissect.

9.15 – What rapid changes impact property prices? And how do transport links affect this?

11.00 – What premiums will buyers pay for an easy PT commute?

17.00 – What are the likely impacts of higher density hubs in designated locations?

26.48 – Next week’s teaser: The complexities of Loan to Value Ratios

27.26 – Hunter’s question: If you had $500,000 to invest, where would you invest, Melbourne or Brisbane? And what about $1,000,000?

51.43 – Gold Nuggets

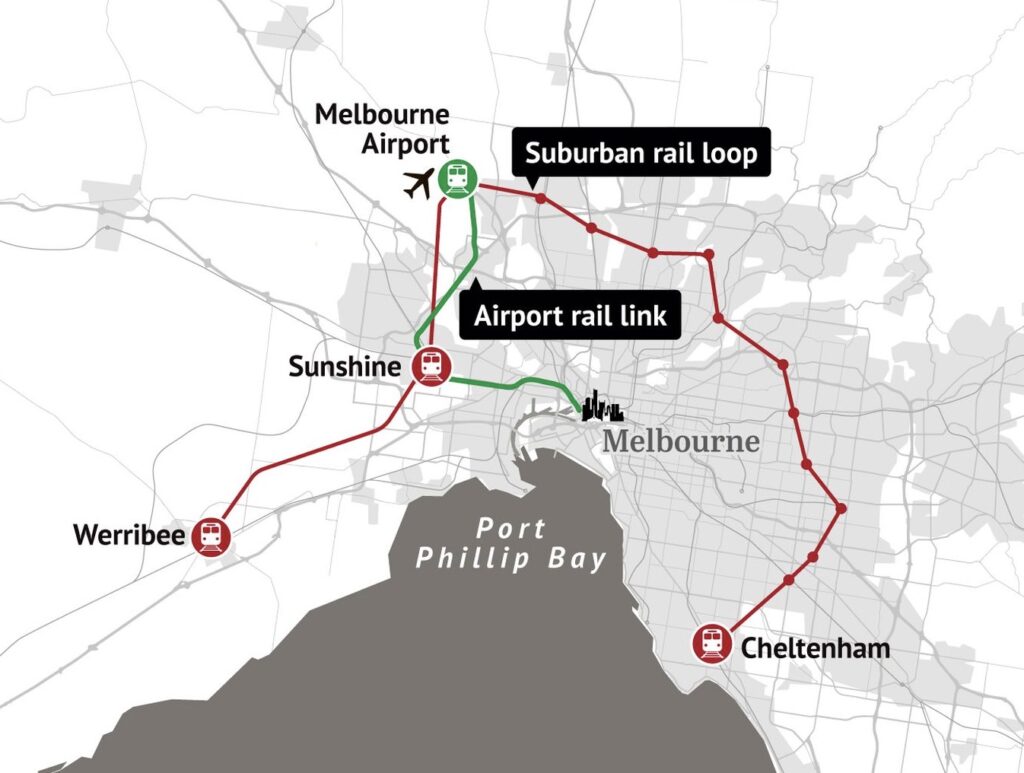

Marilyn’s question is about the suburban rail loop civil works in Melbourne, and how this could influence the suburbs and property markets that are impacted by the project. Dave sheds light on the shortfalls of Melbourne’s current rail lines, and the future changes that the project will enable.

“It is the most expensive infrastructure project in Australian history”.

Mike ponders how the new stations and hubs could impact different genres of properties and he dares to step into town planning initiatives. Dave asks the obvious question; how will higher density, (and more inhabitants) impact businesses and heightened demand for services?

How could this impact property prices in the 1.6km radius within these affected stations? Cate points out that this insight is transferrable amongst several other cities that have invested in their rail infrastructure.

Cate and Mike discuss the positives of a commutable location with easy transport hubs. Will buyers pay more for an easy commute to work? Absolutely.

What are the likely impacts of higher density hubs in designated locations? The Trio consider the impact across the nation for various planning changes for high-amenity areas.

And Cate raises the question: what do these new stations mean for the various precincts that are impacted? Melbourne has four new train stations hitting the map in 2025 and there will be plenty of positives.

Hunter asks the Trio where they’d invest if they had $500,000 or $1,000,000 in either Melbourne or Brisbane. Cate ponders why Melb vs Brisbane is a popular consideration. Recency-bias from the Olympics, or weather differential are two considerations, but could it be price-points? Or the media?

Is Melbourne’s potential bounce back a factor?

Dave lays done some really important property planning considerations, and Hunter’s scenario is put under the microscope. The Trio unpack some of the complexity that should be considered, and Cate shares some specific Victorian examples at these two price points.

Mike unpacks locations around the country where listings have increased at the highest rate. What are they? And why have the listings exploded? Tune in to find out….

.…. and our gold nuggets!

Mike Mortlock’s gold nugget: The strategy is more important than the hotspot!

Cate Bakos’s gold nugget: Rail amenity counts for a lot. What are our town planners thinking, and how is rail infrastructure playing a key role in our growing population threat to traffic congestion?

Resources:

If you’ve enjoyed this show, you may enjoy these episodes:

Related eps:

#21: Why price point should determine location and strategy

#36: Buying the wrong property and/or the wrong location – No. 6 of the top 7 Critical Mistakes

#53: Diversification 101 – How and why to plan for diversification within your property portfolio

#114: Brisbane Olympics 2032 – is now the time to buy an investment property in Brisbane? Infrastructure upgrades, re-purposed athlete villages, new developments and more!

#270: How to Build a Diversified Investment Portfolio – Aligning Personal Goals with Timing, Age & Inheritance