Ep. 281: Mastering Accessing Equity: Loan to Value Ratio Strategy, Risks, Benefits, and Hidden Opportunities that Shape Your Mortgage Strategy

Ep. 281: Mastering Accessing Equity: Loan to Value Ratio Strategy, Risks, Benefits, and Hidden Opportunities that Shape Your Mortgage Strategy

1.19 – Mike wishes Cate a happy 50th!… he then kicks off the LVR episode

5.28 – There are nuances that buyers need to be aware of when it comes to mortgage insurance.

11.30 – The Trio reflect on the changes over time in relation to LVR. The ‘good’ old days required a far greater deposit percentage.

17.33 – our Prudential Regulator plays a strong role when it comes to LVR. What are the metrics they pay attention to?

20.28 – Next week’s teaser: It’s a thriller… tax deductions! How can investors boost their tax benefits?

30.06 – A different beast… Cross-securitisation. Does have it’s place?

39.08 – Gold Nuggets

Today’s episode is all about loan to value ratio’s (LVR). Mike throws Dave the first question.

“In twenty words or less, what is LVR?”

Cate delves into the reasons why LVR is so important when it comes to Mortgage Insurance. Managing risk is what lenders do, but once a buyer triggers mortgage insurance, dwelling types, quirks and risks count for a lot. Heightened scrutiny and having the final say on loan approval is something that a mortgage insurer often holds.

Cate also explores those professionals who get exemptions when it comes to LVR and mortgage insurance waivers. Dave’s examples bring this point to life; from postcode restrictions to zoning types to the property condition. Policies vary greatly among lenders and it can be quite complex. Cate also shares some of her experiences and insights in relation to tricky properties that sometimes pack a nasty lending surprise. Strategic mortgage brokers can assist with the associated challenges.

Dave shares the history of LVR and Lenders Mortgage Insurance in Australia with the listeners… a step down memory lane for some, but a significant step for home ownership in Australia.

Cate reminisces about the impact of smaller deposits and the burden of Lender’s Mortgage Insurance. Is it a cost of doing business? Absolutely, but it’s tough on first home buyers. Cate’s support of the First Home Guarantee is strong, but she feels our Government need to offer more places to eligible applicants. And the 2% savings guarantee for eligible single parents is one policy she loves.

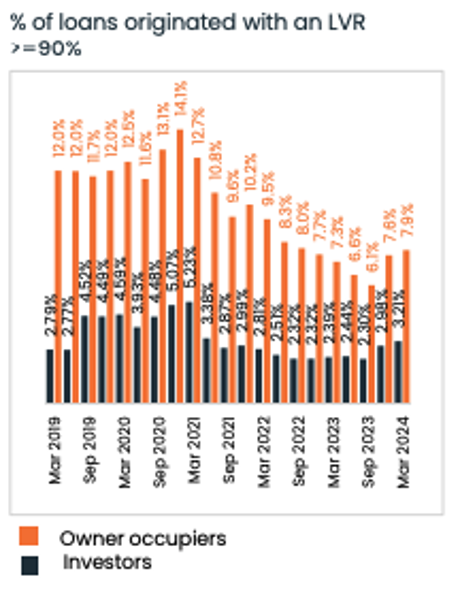

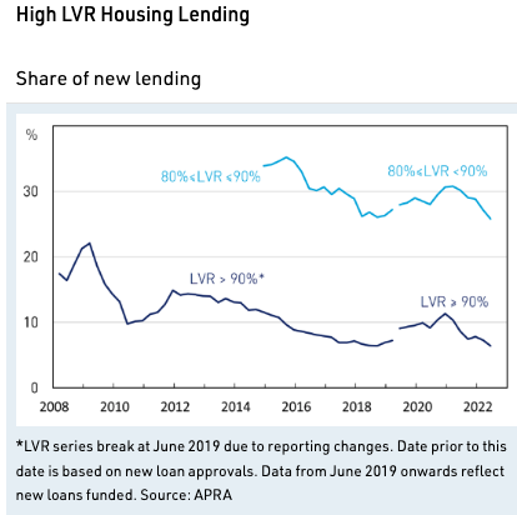

LVR can be a great metric to track our prudential regulator’s level of concern. Macro-prudential policy intervention is evident when we look through the history books at high LVR loan origination. But what does the current five-year data show us? Tune in to find out.

We talk a lot about macro-prudential regulation and how it affected credit, particularly for investors during the 2014 – 2019 period. APRA intervened, and before we knew it, lending became tough, despite reasonable interest rates. Credit was almost impossible for investors. Dave talks our listeners through the challenges of this period and the impact that our regulator had on the property market.

LVR is a viable measure of health that a lot of investors and businesses use. Cate talks us through the concept of overall LVR, and how it can be reduced/optimised.

Lastly, Cate and Dave touch on cross-securitisation… the good, the bad, the ugly.

.…. and our gold nuggets!

Cate Bakos’s gold nugget: Buyers must manage risk when they are in high LVR territory when they are making unconditional offers.

Dave Johnston’s gold nugget: “LMI is the cost of doing business, as Peter Koulizos has told us.” Dave talks about the benefit of being open minded to a higher LVR and LMI in order to get into the marekt earlier.

Mike Mortlock’s gold nugget: Mike talks about the potential cost of avoiding LMI, and he reminds listeners that these costs can be modelled.

Resources:

If you’ve enjoyed this show, you may enjoy these episodes:

Related eps:

#24: How mortgage strategy shapes your ability to hold property and how it can pay off for decades to come

#99: Cross collateralisation – Myths busted, best loan structures, mortgagee sales and more

#191: Risk management and the things that can go wrong when mortgage strategy is ineffective

#230: Equity Unleashed: Property Planning & Borrowing for Renovations & Wealth Creation

#250: Investment Borrowing Masterclass – Maximise Tax Deductions and Advanced Mortgage Strategies for Long-Term Wealth Creation

Further resources: