Ep. 301: Market Update Feb 25 – Melbourne Takes the Lead in Value Growth, Upper Quartile Leads Recovery and Buyer Sentiment Rises

This week, Dave and Cate enjoy sharing the Monthly Market Update while Mike is cycling through Thailand for a very special charity ride.

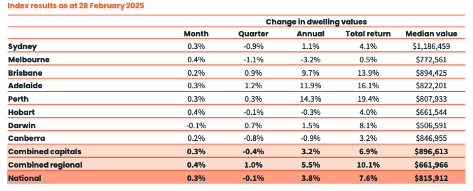

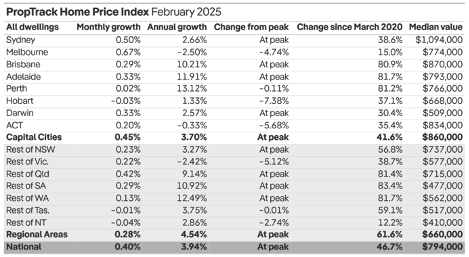

The duo unpack the February indices…. and they circle Melbourne and canvas the coalface, the metrics and some of the growth drivers. One month isn’t a trend, but Cate and Dave have certainly experienced an uptick in activity and buyer sentiment since the auction season started in 2025.

Dave highlights two of our indices that we subscribe to, and interestingly PropTrack has slightly different readings.

February can be a fully month, and Cate explains how some of this pent-up energy after a long Christmas break can often show peaks in this short month.

The regions continue to hold firm and Dave and Cate chat about market segmentation. Trends emerge when markets transition, and the duo consider some of the key differences between 2024 and 2025.

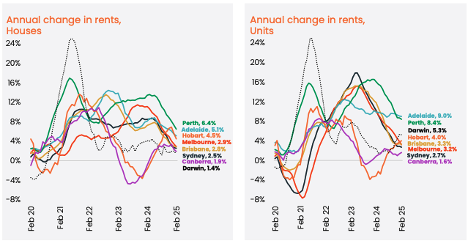

Rental rates continue to broadly moderate. “We’ve had a perfect correlation between our rental growth and the amount of air time that politicians get to discuss the rental crisis.” Darwin has continued to surprise though and the duo consider the highs of 2021’s rental movement in Darwin and the cause of this incredible spike.

Dave reminds us of the stagnant nature of rental growth in the ten years prior to COVID however, and cites Pete Koulizos’s claim that rents have merely been playing catch up.

Household formation rates have increased of late though, and in tandem with the normalisation of overseas migration, it’s little wonder that the rental growth rate has slowed.

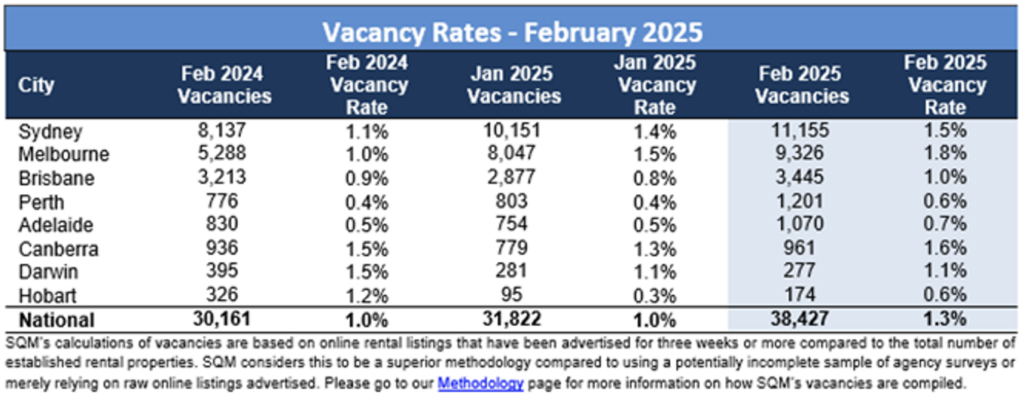

We’ve seen a slight increase in our vacancy rates across the board with the exception of Darwin and Hobart. Sample size and seasonality are two reasons for the variable vacancy rates for these two smaller cities.

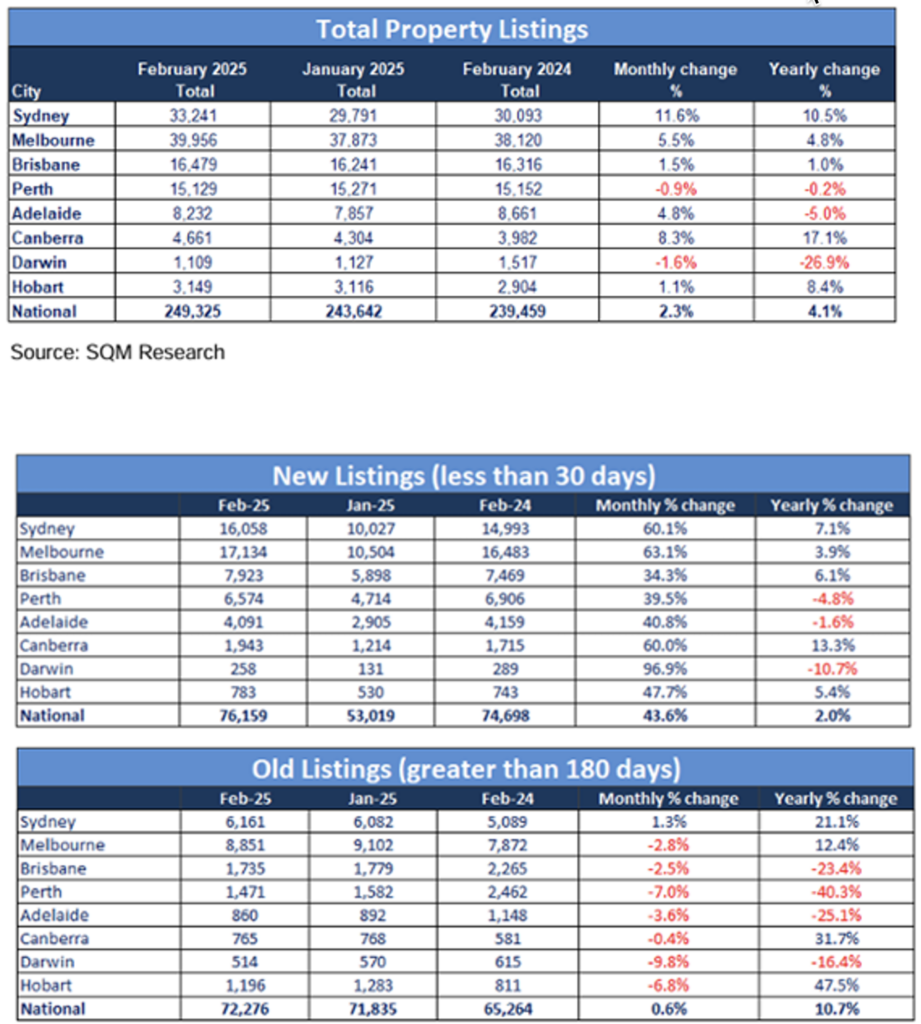

Total property listings tell us a lot about the overall state of the markets. Sydney’s growth is substantial, and in spite of the additional stock levels. However, Perth’s stock count is down, signalling a significant switch in the supply/demand ratio.

What’s happening with Canberra? …and what explains the change? Tune in to find out!

And the duo consider the tough contraction of old listings in the three highest performing markets of 2024 and they consider the correlation.

What does the distressed listing data tell us about Victoria in particular? Keeping a perspective on these numbers is vital though; and as gross numbers, the distressed listing count is not as alarming as some may fear.

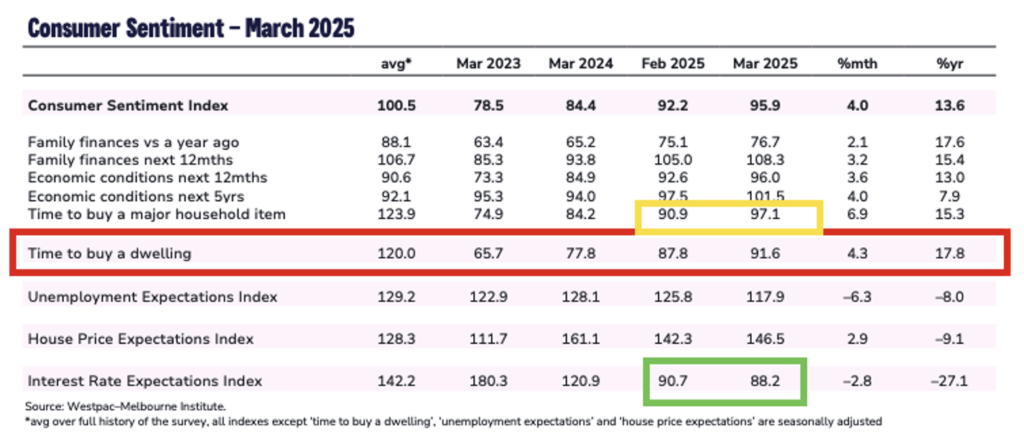

The Westpac consumer sentiment data shows a subtle change following the interest rate cut, but it’s “Time to buy a major household item” that registers the largest movement over the past month. Time to buy a dwelling is a great discussion point when looking at longer range changes, however.

Dave references a segmented consumer sentiment though though, and it shows Victoria surging and WA pairing back substantially. The house price expectations index is still quite high at 145, signalling that people anticipate prices to keep rising. And the interest rate expectations index suggests that consumers are even more optimistic about cash rate movements.

New loan commitments aren’t showing enormous changes over the past quarter, but Christmas timing may have a bit to do with this. Cate circles in on personal lending, including vehicles and they consider the impact of financial hardship and the need for some households to turn to unsecured credit.

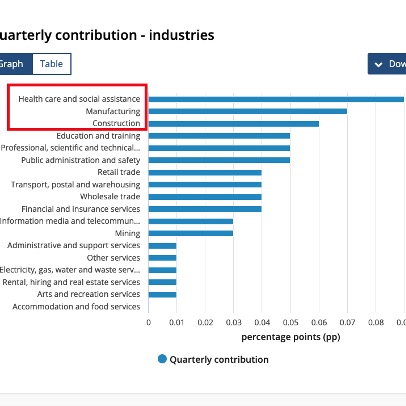

And wage price index figures give us some interesting insights to discuss. A breakdown in the key industries leading the pack show up some of the recent shifts. The seasonally adjusted wage price index rose 0.7% in this quarter; a figure that is much inline with the RBA’s target band for inflation

Lastly, some positive news in the GDP figures give Dave and Cate a degree of optimism about our RBA’s fight on inflation and our domestic economy. All of this is a welcome reprieve when talk of recession has been drifting above us like a dark cloud.

We hope our listeners have enjoyed the show and we’re cheering Mike on from the sidelines!

Resources:

The Property Planner’s Monthly Market Update Blog

- Related eps:

- Ep. 19 TIME IN the market v TIMING the market

- Ep. 21 Why price point should determine location and strategy

- Ep. 129 What is contrarian investing and how can you make it work for you?

- Ep. 158 How interest rate cycles have impacted the property market since 1990 when the RBA first started targeting the cash rate and some predictions on what will happen this time

- Ep. 164 Analysing regional locations – What investment principles can be gleaned from the highest performing regions in each state? Comparing capital city vs regional performance from 2003 – before and after covid

- Upcoming Ep. 302: Can You Predict Property Market Recoveries? Property Cycles & Mean Reversion – Is Melbourne A Hidden Opportunity or a Risky Bet?

Charts sourced from Core Logic, ABS and SQM