Ep. 220 – Decoding RBA Cash Rate Adjustments: The Data Behind the Decisions, Property Market Impacts & the Puzzle of Rising Property Values

Ep. 220 – Decoding RBA Cash Rate Adjustments: The Data Behind the Decisions, Property Market Impacts & the Puzzle of Rising Property Values

<

The final ep in our Inflation Trilogy: Decoding the data behind RBA decisions

Highlight segments:

14.30 – Labour market data: wage growth, unemployment and unit labour costs

17.30 – Dave reminds listeners of the historical inflation figures and the meaning of wage growth spiral

19.20 – Dave sheds light on the relevance of the Australian Productivity Commission

24.55 – Unit Labour Costs explained, “a key measurement that the RBA looks at”.

26.30 – Mike poses a question to Dave about building widgets, a real-life example of productivity boosts

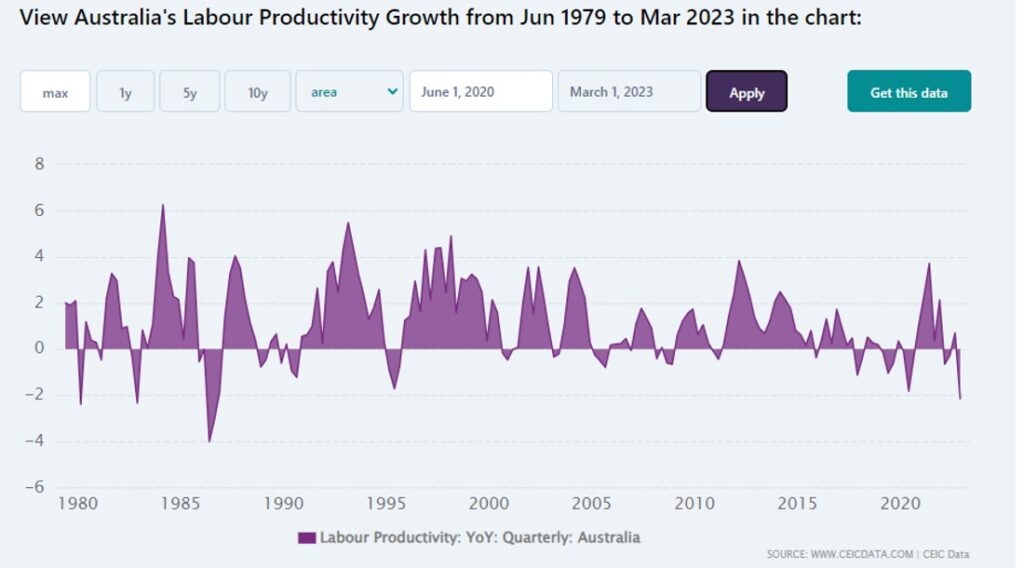

37.25 – Dave shares the history of productivity in Australia

43.28 – Why are overseas economies so important to track?

52.45 – Gold Nuggets

Cate enjoys playing host again and she congrats Dave on the preparation of this challenging set of eps. Simplifying difficult concepts is one of the hardest things to do when presenting information to others.

What data does the Reserve Bank monitor when deciding whether rates should be increased?

- Household consumption – from the Wealth Effect to COVID savings giving rise to YOLO, Dave suggests that this driver is only just starting to come down. Mike recalls the supply chain woes and the cash stimulus that got us to where we are today. Given that most people’s wealth is tied up in property, it is of little surprise that spending went hand in hand with property value growth following the post-COVID price surge.

- Labour markets – Dave describes what this term really means, and he highlights the relationship between unit labour costs (productivity), unemployment and wages growth. “If wage growth is higher than inflation, then our spending power will increase. But we have to get a little bit better at our jobs each year for this to happen,” says Dave.

- Neutral/Preferred Level of Unemployment and Cash Rate – What impact does the unemployment rate have on inflation? Tune in to find out..

- Productivity – From migrant worker initiatives to the Australian Productivity Commission, Mike and Dave cover off the importance of productivity. Mike shares an example about his widget factory with our listeners to illustrate an interesting point. “Long term productivity growth is the key driver of our living standards,” points out Dave.

- Overseas Economies and Interest Rates – From economic interdependence to the flow of capital between countries, there are plenty of factors that are important to note when it comes to overseas economies.

Rising inflation, interest rates, wage costs, and unemployment…. The trio talk about how these might negatively impact the Australian property market with regards to purchasers and renters.

Why have property prices been on the rise despite all of the negative factors weighing on the economy? Dave takes our listeners through nine reasons (and drivers) that explain why our property markets have been so resilient during tough economic times.

What could cause prices to rise again, even if they start to plateau? The Trio ponder this together. We hope you have enjoyed this technical episode.

And our gold nuggets……

Cate Bakos’s gold nugget: “For any listeners with interstate property, it pays to scout around for some good tradespeople.”

Dave Johnston’s gold nugget: Prices are starting to stabilise. “Your trend is your friend” states Dave, but what happens once prices have plateaud? Dave shares his predictions for economic activity and how this will translate into property price movements.

Mike Mortlock’s Mike reminds listeners that they don’t need to master economic data, but they should at least pay attention to RBA meeting notes, what’s happening with the cash rate, and what the RBA is looking at. “….but if you don’t want to subscribe to the RBA, just come to the Property Trio”.

Resources:

Dave has prepared some great notes for our listeners – check out the resources for this topic here.

If you enjoyed this episode, you may also enjoy these:

Ep. 89 – Capital growth – what increases property value?

Ep. 119 – How supply and demand dictates market movements – Part #1 Macro-economic forces

Ep. 217 – The Inflation Conundrum: Unravelling its Causes and Consequences