Ep. 221 – Analysing Market Mindset – Gun-Shy Buyers, Developer Exits, Houses vs Units & Investor Concerns

Highlight segments:

8.50 – Cate contrasts house vs unit performance from today to thirty years ago

19.21 – Dave translates the data in the survey to the concerns associated with interest rate rises

20.20 – Dave sheds light on the relevance of the Australian Productivity Commission

21.15 – Is this the best time to buy? Cate talks about RBA decisions and buyer motivation with Dave

25.16 – A sneak peak into next week’s show

27.11 – Who is right and who is wrong about Dr Lowe? Mike, or the survey respondents?

36.50 – Mike talks about some of the challenges landlords face and he raises an important point

52.25 – Gold Nuggets

Cate enjoys playing host again, this time as the trio unpack the API survey, (Australian Property Investor magazine). They reminisce about the good old days, when the mag used to hit the shelves each month and they’d earmark articles, celebrate their own appearances in the magazine, and collect the publications, filled with post-it notes.

The gap in performance between houses and units has closed a little recently and Dave notes that the data doesn’t really capture this in the survey.

“In fact, houses are the preferred intended purchase over the next 12 months among 37 per cent of respondents, a seismic shift from the mere 21 per cent with that intention just three months ago.”

From land to asset ratio to cultural housing preferences, there are a few reasons why houses are still preferred dwellings.

Mike addresses the issue that developers are currently facing as they are deterred by building sector cost woes. Numbers have declined from 16.5 per cent to just 9 per cent of those planning to procure a property. Mike shares how he expects this indicator to play out in the market now that new dwellings have become a headline topic for every second political story.

Another interesting question that the survey polled related to the transacting activity in the last year. The proportion of people saying they’d made no property moves in the past year soared from 13 per cent to a remarkable 30 per cent in just three months…. not surprising given the interest rate moves, but Dave tackles this question and talks about some of the challenges buyers face beyond funding costs.

The survey also found that of the 70 per cent of respondents who transacted on property in the past 12 months, 63 per cent of those did so on more than one property. Mike discusses the obvious opportunity that many investors took advantage of during this time.

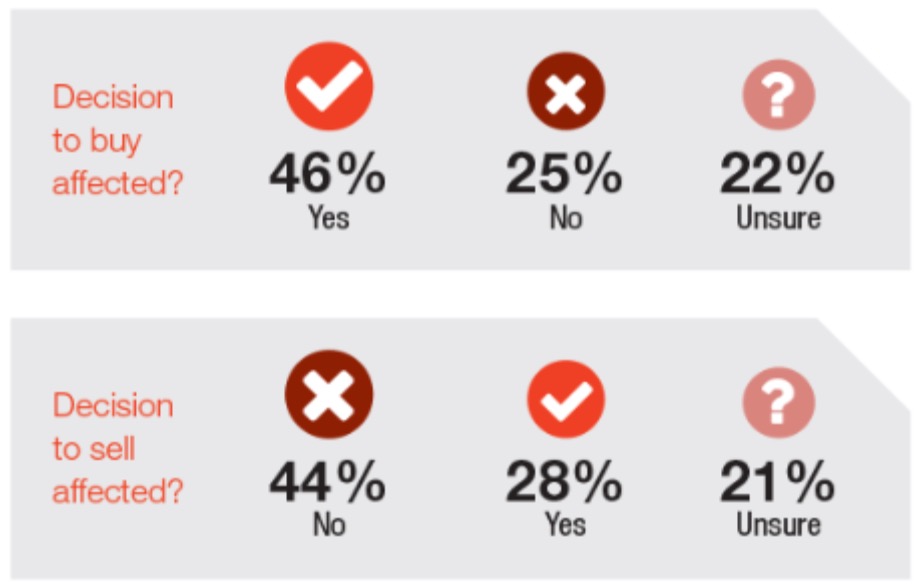

Interest rates remain, together with the associated difficulties caused by a lack of finance availability, the biggest concerns confronting survey respondents. Dave addresses this issue head on and he and Cate discuss how they have seen purchasing decisions, buyer motivation (and timing) impacted by RBA rate decisions. Their insights may surprise our listeners…

Cate shares the survey findings around decisions to buy and decisions to sell. Surprisingly, it’s the buyer camp who are most impacted by rate increases. This is despite record low listing activity during this period.

Mike considers the RBA and the respondents’ feelings about the performance of our Reserve bank. A troubling 47 per cent of respondents gave the RBA a fail mark for having performed to a poor or very poor level. The amount that gave the RBA a mark of average or above was 54 per cent, well down from the 61 per cent of last quarter. Tellingly, the big shift was in the proportion that rated the RBA’s efforts as very poor, which took off from 15 to 25 per cent in the past three months. The trio pick apart some of the key mistakes that our former RBA Governor made.

Rents continue to be a heady topic. Cate and Dave break down some of the findings and they ponder the negative views of investors within the community, and how investor disincentives are playing out now.

The Trio often talk about the Westpac consumer sentiment figures on property recently, but this survey highlights some different views; Respondents believed that there is plenty more upside in the property market, with 72 per cent expecting property prices to increase nationally, while 55 per cent believe regional property prices will increase. Time will tell!

From investor concerns, dwelling types that investors wish to invest in, states they’d like to invest in, and investor intentions over the following year, the survey findings show some intriguing predictions. We hope you have enjoyed this episode… and especially with some of Mike’s ‘easter eggs’.

And our gold nuggets……

Dave Johnston’s gold nugget: If we look at the things that are putting people off buying, it’s the external factors. “The most important economy is your own economy.”

Mike Mortlock’s gold nugget: Mike talks about the disparity out there right now in relation to buyer sentiment. “If you’re in a position to purchase a property, now is the time to do it.”

Resources:

Dave has prepared some great notes for our listeners – check out the resources for this topic here.

If you enjoyed this episode, you may also enjoy these:

Ep. 97 – What will drive capital growth after interest rates rise?