Ep. 225 – Navigating the Fixed Rate Mortgage Cliff – Is It Real or Hype? Data Behind Headlines, Property Market Repercussions & Managing Risk

Ep. 225 – Navigating the Fixed Rate Mortgage Cliff – Is It Real or Hype? Data Behind Headlines, Property Market Repercussions & Managing Risk

Highlight segments:

3.10 – Cate opens the discussion about “The mortgage cliff”

6.30 – Dave explains what the mortgage cliff actually means

9.31 – Cate offers a pub comparison to fixed rate lending during COVID

12.55 – Mike shares some light reading on an RBA hypothesis

14.00 – Cate defines negative equity and what can cause it

18.36 – Dave falls prey to one of Mike’s easter eggs 😉

21.58 – Teaser for next week’s show – Alison reaches back out to us about buying in beachside Mentone

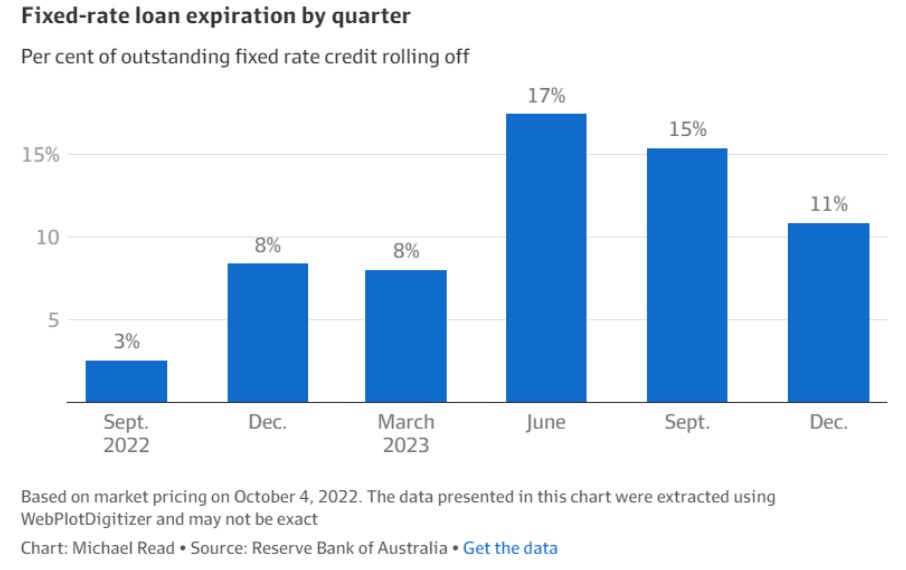

27.13 – Mike distills some data in relation to fixed rate loan expiry

28.00 – Mike references the graph in our show notes

35.01 – And our gold nuggets!

Mike bravely delves in to mortgages…. and dares to ask whether the mortgage cliff is a threat to our property market.

Is it a beat-up? Or is it something we should be bracing for? Dave mentions the Y2K bug and questions the power of fear.

“Millions on Mortgage Cliff” is a headline Mike cites, and he plans to challenge the magnitude quoted.

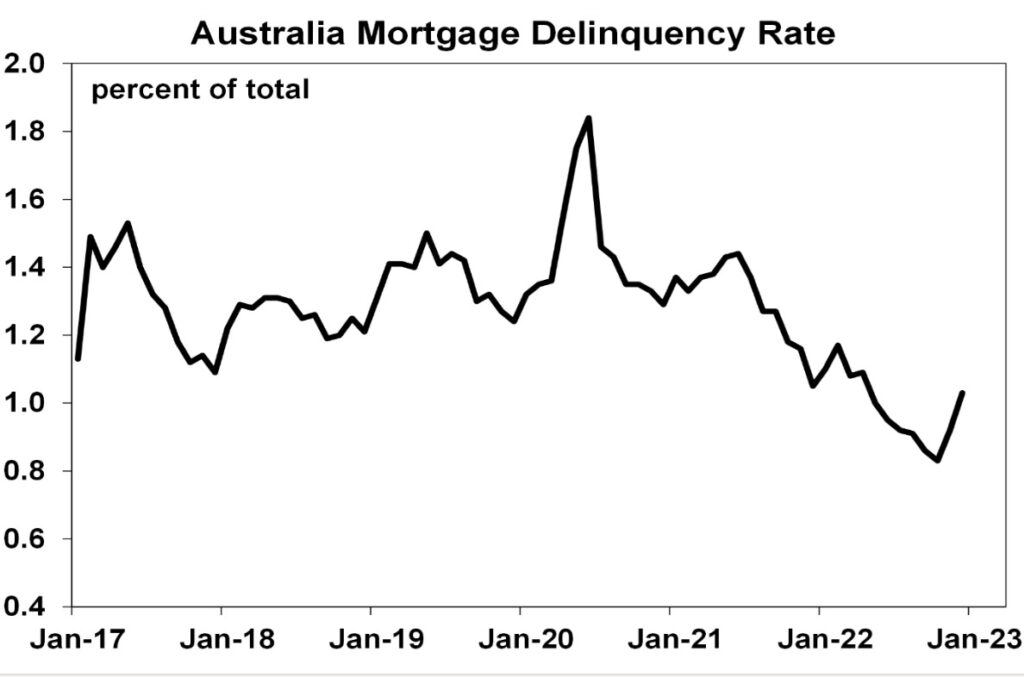

Mortgage stress, mortgage delinquencies and timelines are on Mike’s discussion list.

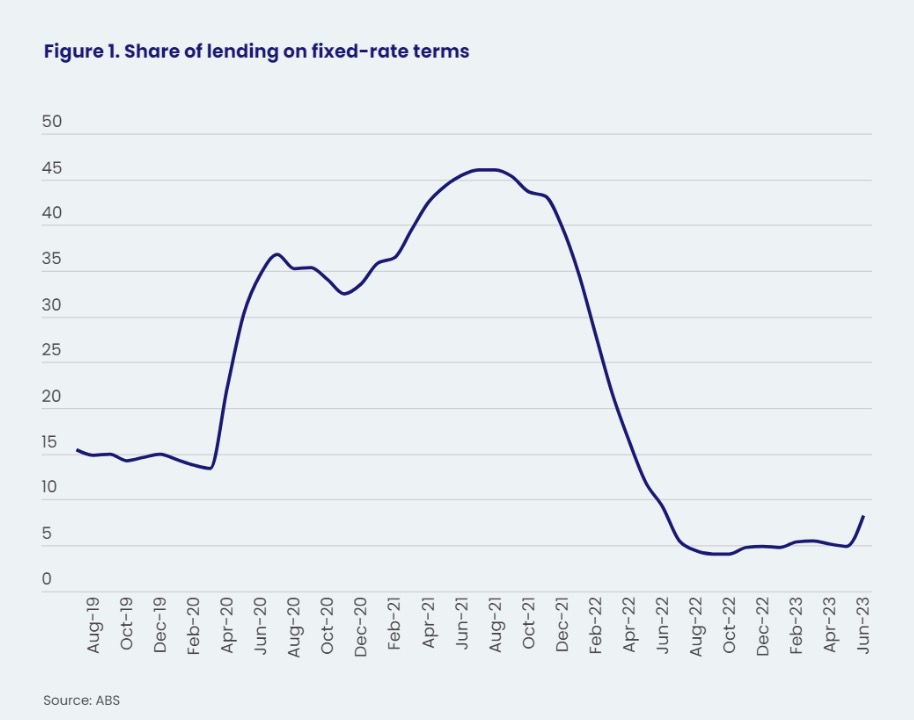

Firstly, Dave explains the concept of the fixed rate cliff, and sheds light on what is is that the media have many gripped with fear (or hope) about. It essentially hinges on a large volume of exceptionally cheap loans that are coming out of fixed rate and re-adjusting to today’s variable rate. For many borrowers, their holding costs will be considerably higher this year. However, the Trio are determined to uncover the numbers, the percentages and the truth about the fixed rate cliff claims.

Cate ponders why more people didn’t fix during the pandemic and finds a good bar-tab comparison.

“The determinants of mortgage defaults in Australia; evidence for the double-trigger hypothesis” is a paper that Mike stumbled across. Jokes aside; negative equity is strongly correlated with whether a loan is in arrears. The Trio define and unpack this for our listeners.

From high LVR loans to reducing credit, Cate and Dave ponder the impact of regulator intervention. Dave points out that global economies vary greatly, and the pair share some examples of past lending practices that are not so commonplace today.

While Mike has some fun with the special effects and the audio bleeps, Dave gets serious about shedding light on the real numbers when it comes to mortgage arrears. Rising property values and regulatory control over credit have certainly shielded our nation from broad arrears. Mike shares some stats and it’s a compelling data set. Tune in to find out more…

Cate asks Dave about refinancing activity. Despite the value of new lending deteriorating, the rate of refinancing is MASSIVE. The value of external refinancing is up a massive 21% over the last year. What are the reasons? Dave expands… it’s intriguing to hear first-hand from a business owner about the behind-the-scenes of a mortgage broking business during COVID.

“Mike, the numbers seem large…” Cate quizzes Mike about some of the stats quoted in relation to the expiry of fixed rate loans and Mike puts the numbers into perspective. It’s a must-listen!

The vast majority of lending is on variable rates and Mike’s numbers-brain looks over the data and contrasts it to the claims.

“There’s a lot more to be positive about than the media lets on”.

Cate considers the plight of first home buyers who were not entirely prepped for higher interest rates, and she points out that two per cent was never sustainable.

“One third of people have a mortgage, one third of people have paid off their mortgage, and one third rent”.

And Dave’s overview of ASIC’s position and the non-bank lenders is intriguing. We hope our listeners have gleaned some good insight from this ep.

And our gold nuggets……

Mike Mortlock’s gold nugget: While some new variable rate mortgage holders will be feeling some pain, spending is moderating and Mike holds hope that the ‘mortgage cliff’ is a bit of a beat up. He believes that rate cuts are likely to be around the corner. “It’s not a cliff… that’s my summary.’

Dave Johnston’s gold nugget: Dave also feels that it’s not a cliff either. It will likely have a ‘slow tail’ and there will be some pain, but not so much in the owner occupier residential market.

Cate Bakos’s gold nugget: Overall, there will be a mortgage cliff for some individuals, but Cate doesn’t think that there will be advantageous buying conditions as a result. We have to consider the other forcefields; new arrivals (skilled migrants), a rapid increase in rents, and we also have to consider the impact of inflation on property values, and lastly; confidence from high employment.

Resources:

If you enjoyed this episode, you may also enjoy these:

Ep. 9 – Why your mortgage strategy is more important than your interest rate?

Ep. 34 – No mortgage strategy – No.4 of the top 7 Critical Mistakes

Ep. 191 – Risk management and the things that can go wrong when mortgage strategy is ineffective